Researched and Compiled by Rachit Seth .He is an Architect working in New Delhi

The mainstream media and our public discourse in general have focused on one single word “Corruption” since the past few years. Never has the discourse on Transparency in Public Life been so volatile and argumentative.

In the daily cacophony of alleged scandals and ‘scams’- the public discourse has somewhat largely left the positives done by the Government.

Here is a list of facts which highlight the gradual, but definitive ‘Silent Transparency Revolution’ being ushered in India by the ‘System’ itself.

Facts can only be measured, but can’t be denied.

Also miles to go, before we sleep…

- India ratified the United Nations Convention Against Corruption in May, 2011.

- The Convention has entered into force for India on 8th June 2011.

- The Lokpal and the Lokayukta Bill has been already introduced in the Parliament.

- The Public Procurement Bill, 2012 already introduced in Parliament

- Grievances Redressal Bill already introduced in Parliament

- Foreign Bribery Bill already introduced in Parliament

- Judicial Accountability Bill already introduced in Parliament

- The Whistle Blowers Protection Bill, 2011 already introduced in Parliament

- The Consumer Protection (Amendment) Bill, 2011 already introduced in Parliament

- The Prevention of Money Laundering (Amendment) Act passed by UPA

- The Electronic Delivery of Services Bill already introduced in Parliament

- IPRs of Group ‘A’ Central Officers placed in public domain

- Aadhaar- Direct Benefits Transfer- Institutional architecture to facilitate a shift to a system in which benefits from the government would get transferred directly to the bank accounts of individual beneficiaries of various social sector schemes

- Benami Transaction (Prohibition) Bill 2011 introduced in Parliament. The Bill elaborately covers definition of ‘benami’ property and transaction, and prohibits benami transactions.

- UPA is the Only Government in Modern India to pass the Historic Right to Information Act, 2005 to usher in transparency in governance through citizen participation.

- RTI Act has empowered lakhs of individuals and have made the state responsible. A revolution has taken place ever since, and people have become more aware of their rights and procedures

- UPA Government is the first Government in India to envisage National Data Portal for Transparency in Governance

- UPA Government of has commissioned a study on unaccounted income/ wealth both inside and outside the country bringing out the nature of activities engendering money laundering and its ramifications on national security in March 2011

- UPA Government is the first Government in India to present a White Paper on “Black Money” in May 2012

- A Directorate of Criminal Investigation (DCI) has been created as an attached office of the Central Board of Direct Taxes (CBDT) to track financial transactions relating to illegal / criminal activities, including illicit cross-border transactions, from the direct tax angle and bring such activities to justice.

- CBDT is coordinating with the Election Commission of India (ECI) for controlling political expenditure and verification of affidavits filed by candidates of political parties.

- Government has set up Exchange of Information (EoI) Cell for an effective exchange of information to curb tax evasion. Efforts are on to put the cell in place under Foreign Tax Division of CBDT

Prevention of Benami Transactions

- One of the important initiatives taken by the Government is the introduction of the Benami Transaction(Prohibition) Bill 2011.

- This comprehensive legislation was introduced in the Lok Sabha on 18 August 2011 and is currently being examined by the Standing Committee on Finance.

- It will iron out the infirmities in the Benami Transaction (Prohibition) Act enacted in 1988 and formalise the procedure for implementing the benami law, including the procedure for determination, confiscation, prosecution, and miscellaneous requirements.

- This Bill defines benami property and a benami transaction in terms of a transaction or agreement where a property is transferred to or held by a person for a consideration provided or paid by another person.

- Such a property is held for the immediate or future benefit, direct or indirect, of the person providing the consideration. A transaction or arrangement in respect of a property carried out or made in a fictitious name or where the owner of the property is not aware of or denies knowledge of such ownership is also included in the definition of benami transaction.

- The Bill specifies the consequences of benami transactions in the form of confiscation of the benami property and imprisonment up to two years in addition to a fine.

- This Bill also provides the procedure for enquiry and determination of benami property and its consequences as well as the authorities empowered to act for this purpose, including the appellate authorities.

- The Standing Committee Report was sumbitted on Jun 26, 2012

- The Bill was slated to be introduced in the Budget Session in 2013, but could not introduced due to disruption by opposition

Lokpal Bill

- The Government constituted a Joint Drafting Committee on 08.04.2011, consisting of five nominee Ministers from Government of India and five nominees of

- Anna Hazare (including Shri Hazare himself), to prepare a draft of the Lokpal Bill.

- Based on the deliberations of the Committee, and on the basis of inputs received from Chief Ministers of States and political parties, Government prepared a revised Lokpal Bill, 2011 which was introduced in the Lok Sabha on 04.08.2011.

- The Government introduced a new comprehensive Lokpal and Lokayuktas Bill,2011 in the Lok Sabha on 22.12.2011 to establish the institution of Lokpal at the Centre and Lokayukta at the level of States along with the Constitution 116th Amendment Bill, 2011 to provide for the Constitutional status to these bodies.

- These Bills were taken up for consideration by the Lok Sabha on 27.12.2011.

- The Lokpal and Lokayuktas Bill, 2011 was passed with certain amendments whereas the Constitution 116th Amendment Bill, 2011 could not be passed with the requisite majority required for Constitutional amendments.

- The Lokpal and Lokayuktas Bill, 2011 was taken up for discussion and passing in the Rajya Sabha on 29.12.2011.

- The Bill was taken up for consideration and passing in the Rajya Sabha, which referred it to a Select Committee.

- Select committee report was tabled in Rajya Sabha in November 2013

- On February 5th, 2013, Cabinet accepted most recommendations of the Select Committee, Bill was stated to be introduced in Budget Session, but could not be taken up because of opposition disruption.

- Protection of Whistle-blower Bill

- The Government had issued a Resolution dated 21st April, 2004 authorizing the Central Vigilance Commission as the designated agency to receive written complaints from whistle blowers.

- The said Resolution also, inter alia, provides for the protection to the whistle blowers from harassment, and keeping the identity of whistle blowers concealed.

- As it was felt that the persons who report corruption need statutory protection, a Bill titled “The Public Interest Disclosure and Protection to Persons making the Disclosures Bill, 2010” was introduced in Parliament.

- The Bill was referred to the Department related Parliamentary Standing Committee on

- Personnel, Public Grievances, Law and Justice which, in its 46th Report, made several recommendations, suggesting several amendments in the Bill.

- The recommendations were considered by the Government and a majority of the recommendations were accepted by the Government.

- Significantly, the recommendation for change of name of the Bill was accepted and the Bill was amended as “The Whistle Blowers Protection Bill, 2011”.

- The recommendation of the Standing Committee for bringing the members of Council of Ministers, the judiciary including the higher judiciary, regulatory authorities,etc. within the ambit of the Bill was accepted, with the exception of Judges of the Supreme Court and the High Courts since aspects of whistle blowing in so far as they relate to judges of the Supreme Court and High Courts, has already been taken care of in the Judicial Standards and Accountability Bill, 2010.

- The recommendation of the Standing Committee for inclusion of Armed Forces, Security and Intelligence Agencies, etc within the purview of the Bill was also accepted by the Government. Official amendments were moved for this purpose.

- The Bill, as amended, was passed by the Lok Sabha on 27th December, 2011 and was included in the List of Business of the Rajya Sabha on 28th December and 29th December, 2011, but the same could not be taken up for consideration in the Rajya Sabha on both these dates due to opposition disruption

Goods and Services Tax Network (GSTN)

- The Cabinet has approved a proposal to set up a special purpose vehicle -GSTN (GSTN SPV) for providing shared IT infrastructure and services to central and state governments, taxpayers, and other stakeholders for implementation of the goods and services tax (GST), both before and after the rollout of GST.

- During the pre-GST stage, the services on offer would include taxpayer utility, common return submission along with tracking mechanism for inter-state trade, common tax payment gateway, common registration for states (value-added tax [VAT] and central sales tax [CST]) and centre (central excise and service tax) and building interface between the GSTN Common Portal and state/centre tax systems.

- The GSTN SPV would be substantially funded through a one-time non-recurring grant-in-aid of Rs 315 crore from the central government towards expenditure for setting up and functioning of the SPV for a three-year period after incorporation

Judicial Standards and Accountability Bill

- The Judicial Standards and Accountability Bill, 2010 was introduced in the Lok Sabha on December 1, 2010.

- The Bill was introduced by the Minister of Law and Justice.

- The Bill was referred to the Standing Committee on Personnel, Public Grievances, Law and Justice which submitted its report by August, 2011.

- The Judicial Standards and Accountability Bill tries to lay down enforceable standards of conduct for judges.

- It also requires judges to declare details of their and their family members’ assets and liabilities.

- Importantly, it creates mechanisms to allow any person to complain against judges on grounds of misbehaviour or incapacity.

- The Bill establishes three bodies to investigate complaints against judges: the National Judicial Oversight Committee, the Complaints Scrutiny Panel and allows for the constitution of an investigation committee.

- The Bill with some amendments was passed by the Lok Sabha on Mar 29, 2012

- The Bill is now pending in Rajya Sabha, was slated to be introduced in the Budget Session, but couldn’t be introduced due to opposition disruption.

Judicial Reforms

- The National Mission for Justice Delivery and Legal Reforms was launched in the Department of Justice for increasing access to justice by reducing delays and arrears, enhancing accountability through structural changes and setting performance standards and capacities.

- Information such as filing of petition, allotment of cases to courts, generation of cause list, date of hearing and status of the case can be ascertained from judicial service centres set up by district and subordinate courts.

- An amount of Rs 595 crore was released to the states for infrastructure development for the lower judiciary in 2011- 12.

- Funding pattern for this purpose between the centre and the states was revised from 50:50 to 75:25, making the scheme more attractive for states.

- Under the 13th Finance Commission award, Rs1353 crores was released to the states in 2010-11 and 2011-12 for special courts, lok adalats and training of judicial officers.

Foreign Bribery Bill

- Our domestic laws are substantially compliant of the mandatory provisions of the UN Convention except the requirement relating to bribery of foreign public officials and private sector bribery.

- In regard to the bribery of foreign public officials a standalone Bill titled “The Prevention of Bribery of Foreign Public Officials and Officials of Public International Organizations Bill, 2011” was introduced in the Monsoon session of Parliament

- It was then referred to the Department related Parliamentary Standing Committee on

- Personnel, Public Grievances, Law and Justice which submitted its report on 29th March, 2012

- The Bill empowers the Central Government to enter into agreements with other countries (contracting states) for enforcing this law and for exchange of investigative information.

- The Prevention of Bribery of Foreign Public Officials and Officials of Public International Organizations Bill is now pending to be tabled in Parliament

Group of Ministers to consider measures to tackle corruption

- The Government had constituted a Group of Ministers (GoM) in January, 2011,to consider measures that can be taken by the Government to tackle corruption.

- This Group has been entrusted with the task of considering all measures, including legislative and administrative, to tackle corruption and improve transparency.

- The Group’s mandate was to put in place comprehensive roadmap for strategizing and spelling out measures for tackling corruption in Government.

- The specific areas which the GoM is looking into are:-

- State funding of elections

- Fast tracking of all cases of public servants accused of corruption

- Ensuring full transparency in public procurement and contracts, including enunciation of public procurement standards and a public procurement policy

- Relinquishing discretionary powers enjoyed by Ministers

- Introduction of an open and competitive system of exploiting natural resources

- Amendment to the Constitution to provide for summary proceedings in cases of grave misdemeanor or blatant corruption by public servants

- Consideration of relevance/need for retaining provision relating to prior government permission before commencing investigation against high public officials

- The Group of Ministers (GoM) set up in January 2011 to consider measures to tackle corruption has submitted two reports.

- Government has accepted the recommendations of the Group with minor modifications.

- In pursuance of this, In 2011, Government had directed that requests for sanction of prosecution are to be decided upon by the competent authority within a period of three months.

- Government decided that for all officers of the central government above the rank of Joint Secretary, the competent authority to approve initiation of enquiry/investigation under Section 6A of the Delhi Special Police Establishment Act will be the Minister-in-charge in the Government of India.

- Government has also accepted the recommendation of the GoM to put in place regulatory parameters for exercise of discretionary powers by Ministers and to place them in public domain.

Citizens Grievances Redressal Bill, 2011

- The Government recently introduced the Right of Citizens for Time Bound Delivery of Services and Redressal of their Grievances Bill, 2011 in Parliament.

- Under the Bill every public authority is required to publish a Citizens Charter specifying the category of goods supplied and services rendered by it, the time frame within which such goods shall be supplied or services be rendered; to establish information and facilitation centre for efficient and effective delivery of services and redressal of grievances and to designate Grievance Redress Officers (GRO) in all public authorities to enquire into and redress any complaints from citizens.

- The Bill provides for constitution of the State Public Grievance Redressal Commission and the Central Public Grievance Redressal Commission for respective appeals against the decision of GRO and imposition of penalties in case of failure on the part of designated official responsible for delivery of goods and services or GRO.

- The designed authority at the grass-root level will have powers to redress most of the grievances at the district and sub-district level.

- The Bill was introduced in the Lok Sabha on December 20, 2011.

- The Bill was referred to the Department Related Standing Committee on Personnel, Public Grievances, Law and Justice.

- The Report was submitted on August 30, 2012.

- The Bill is now pending in Rajya Sabha, was slated to be introduced in the Budget Session, but couldn’t be introduced due to opposition disruption.

Public Grievances

- The Department of Administrative Reforms & Public Grievances (DARPG) has taken major Citizen Centric initiatives related to public grievance redress during the year.

- The Sevottam compliant Citizen’s/Client’s Charter of DARPG was prepared and published. Also guidelines for implementing Sevottam, were published in September. These documents are also made available on the website of the Department

- For strengthening the Centralized Public Grievances Redress and Monitoring System (CPGRAMS) in all Central Government Ministries / and State Governments, several initiatives have been taken

e-Governance

- The National e-Governance Plan was approved by the Government with the vision to “Make all Government services accessible to the common man in his locality, through common service delivery outlets and ensure efficiency, transparency & reliability of such services at affordable costs to realize the basic needs of the common man”.

- A network of more than 100,000 Common Service Centres for electronic delivery of public services to citizens in rural areas has been rolled out.

- Computer software tools and fonts have been made available in 22 Indian languages in 24 States.

- Till 2012, Pilots for delivering high-volume, citizen-centric e-Governance services have been implemented in 88 districts across seven states under the e-District Project.

- The MCA-21 e-Governance project for facilitating business by simplifying and reducing documentation was carried forward by enabling online allotment of the Director

- Identification Number and integrating it with the Income Tax PAN. This will substantiallyreduce delays in incorporation of a company.

- A record 15 lakh annual reports were filed during 2011 with a peak of 70,000 filing on a single day.Rules have been amended to facilitate payments by direct credit to the bank accounts of payees.

- A secured electronic payment system, through “Government epayment gateway” has been commissioned to facilitate this process.

- This measure will streamline the process of making payments,minimize the interface of the payees with Government offices and will usher in green banking.

Public Procurement Legislation

- Following the announcement made by the Prime Minister in his Independence Day address of 2011, the Public Procurement Bill, 2012 has been drafted and approved by the Cabinet.

- The Bill seeks to regulate public procurement by all Ministries and Departments of the central government, Central Public Sector Enterprises and bodies controlled by the Central Government to ensure transparency, fair and equitable treatment of bidders, promoting competition and enhancing efficiency and economy in the procurement process.

- The Bill is based on the recommendations of Committee on Public Procurement which were accepted on February 22 , 2012 by a GOM, to tackle corruption.

- The Bill would create a statutory framework for public procurement which will provide greater accountability, transparency and enforceability of the regulatory framework.

- The Public Procurement Bill, 2012 was introduced by the Ministry of Finance in the Lok Sabha on May 14, 2012.

- The Bill is now pending in Rajya Sabha, was slated to be introduced in the Budget Session, but couldn’t be introduced due to opposition disruption.

Electoral Reforms

- In January, 2007 , the Parliamentary Standing Committee on Personnel, Public Grievances, Law and Justice has invited suggestions/views/comments of Individuals /institutions /organisations on Electoral Reforms

- With a view to carrying out comprehensive electoral reforms, a Core-Committee had been constituted on 1st October, 2010 under the Chairmanship of an Additional Solicitor General

- The Committee under the aegis of Legislative Department and in co-sponsorship of the Election Commission of India conducted seven regional consultations at Bhopal, Kolkata, Mumbai, Lucknow, Chandigarh, Bengaluru and Guwahati, wherein the stakeholders have been consulted, who inter-alia included leaders and workers of the political parties, legislators, legal luminaries, representatives of NGOs, eminent persons, civil servants (serving and retired), students etc. and views have been gathered.

- The issue of electoral reforms in its entirety, which inter alia includes the funding of elections, has been referred to the Law Commission of India for its recommendations.

- Law Commission had been requested to submit concrete suggestions in this regard within three months from 16th January, 2013.

- Commission has informed that recommendations on electoral reforms would require extensive consultations within the Law Commission, other stakeholders including Election Commission and Political Parties

Efforts of Government in Tackling Black Money

- The Financial Intelligence Unit of ED(FIU-IND) was established by the Government of India vide an Office Memorandum dated 18 November 2004 for coordinating and strengthening efforts for national and international intelligence by investigation and enforcement agencies in combating money laundering and terrorist financing

- Foreign Exchange Management Act – FEMA- After a 2009 amendment, predicate offences for money laundering also extend to conduct that occurred in another country which constitutes an offence in that country and which would have constituted a predicate offence had it occurred domestically

- The National Investigation Agency (NIA) is a specialised and dedicated investigating agency setup under the National Investigation Agency Act to investigate and prosecute scheduled offences, in particular offences under the Unlawful Activities (Prevention) Act, including Financing of Terrorism

- A High Level Committee headed by the Revenue Secretary and with representatives of the RBI,Intelligence Bureau (IB), ED, CBI, CBDT, NCB, DRI, FIU and the Foreign Tax Division has been constituted with the joint secretary (FT&TR-I) as Member-Secretary. This Committee is entrusted with the responsibility of coordinating investigations

- At the London summit of G-20 in April 2009, India played a major role in developing international consensus for taking action against tax havens.

- It was on India’s initiative in November 2010 at the Seoul Summit that the G20 gave a call for concluding the TIEA (Tax transparency and information exchange agreement)

- Both the DTAA as well as TIEA are effective tax information exchange mechanisms.Since negotiation of a DTAA takes time, which can delay development of the mechanism for effective exchange, India has taken the plea that a country cannot refuse signing a TIEA if it has been requested byother countries.

- It was again at India’s initiative that this position was accepted and now global consensus has emerged that a country cannot insist on a DTAA and must conclude a TIEA if requested by othercountries.

- After this development, many countries that were earlier insisting on DTAAs, have now agreed to conclude TIEAs with India as well other countries of the world.

- India is vice chair of the Peer Review Group of the Global Forum which carries out monitoring and peer review of the member and relevant jurisdictions.

- India’s initiative in these meetings has resulted in many jurisdictions changing their laws and administrative procedures in order to conform to international standards

- The Multilateral Convention on Mutual Administrative Assistance in Tax Matters was developed jointly by the Council of Europe and the OECD .

- The amended Protocol also provides for the opening of the Convention to all countries. India signed the Convention on 26 January 2012 and ratified it on 2 February 2012, thus becoming the first country outside the OECD and European countries to join it.

- India, having met the strict evaluation norms of the FATF, was granted full-fledged membership (34th Member) in June 2010. Further, in recognition of India’s efforts in this regard, the Asia Pacific Group (APG) on Money Laundering and Terrorist Funding chose India as Co-chair of the Group at its annual meeting in Singapore in July 2010.

- For furtherance of the objectives of joining the global efforts against money laundering and bolstering the national programme, India successfully hosted the annual meeting of the APG between18 and 22 July 2011 at Kochi, Kerala. India is fully committed to following the FATF norms of KYC and customer due diligence, illegal transfer of funds and their recovery, and international cooperation

- On 9 May, 2011 India became the 152nd country to ratify the United Nations Convention against Corruption, which was signed on 9 December 2005

- A number of significant changes were brought about through the Finance Act 2011 to check the menace of black money and in line with our joining the global crusade

- General Anti Avoidance Rules (GAAR) have been introduced with effect from 1 April 2014 to check aggressive tax planning with the use of sophisticated structures

- To facilitate the launch of prosecution in cases of evasion of taxes and speedy trial and early conclusion, provisions for constitution of special courts, summons trials, and appointment of public prosecutors have been included.

- It has been provided that deduction on donations to charitable institutions, etc. will be allowed in excess of Rs 10,000 only if they are made in a mode other than cash. The return form has been modified and if a person claims deduction for charity and donation, he has to provide the details such as name, address, and PAN of the donor.

- The electronic filing of tax returns has been made mandatory for individuals having total income more than Rs10 lakh and for resident individuals having any assets outside India.

- In March 2009, in view of the stand taken by the G20 countries, Switzerland announced that it was willing to adopt the international standards on administrative assistance in tax matters and withdrew its reservations about sharing banking information and sharing of information in the absence of domestic interest.

- After this change of policy, India moved swiftly and signed a Protocol for amending the DTAA on 30 August 2010, which came into force on 7 November 2011.

- As per the revised DTAA, Switzerland is obliged to provide banking and other information in specific cases that relate to the period starting from 1 April 2011, with limited retrospective application.

- In most such Protocols, Switzerland has agreed to share information prospectively only and has accepted limited retrospectivity only in case of some countries, such as India

- In 30 out of India’s 82 DTAAs, there is provision for assistance in collection of taxes which facilitates repatriation of assets located outside India to the extent of the outstanding tax demand which cannot be collected in India

- 5 All the TIEAs signed by India have provisions for tax examination abroad. Most of the TIEAs signed by India also contain provision for obtaining past information either in all cases or at least in criminal cases.

- To strengthen the provisions of the Prevention of Money Laundering Act amendments were carried out in 2009. More offences have been added including those pertaining to insider trading and market manipulation as well as smuggling of antiques, terrorism funding, human trafficking other than prostitution, and a wider range of environmental crimes

- PMLA 2002 is further proposed to be amended through the Prevention of Money Laundering (Amendment) Bill 2011, which is under consideration of Parliament.

- The Bill seeks to introduce the concept of ‘corresponding law’ to link the provisions of Indian law with the laws of foreign countries and provide for transfer of the proceeds of the foreign predicate offence in any manner in India.

- It also proposes to enlarge the definition of the offence of money laundering to include therein activities like concealment, acquisition, possession, and use of proceeds of crime as criminal activities and remove the existing limit of ` five lakh for imposition of fine under the Act

- India has completed negotiation of 62 DTAAs/TIEAs (29 existing DTAAs, 16 new DTAAs, and 17 TIEAs) and have signed 33 DTAAs/TIEAs (23 DTAAs, 10 TIEAs).

- As a result today India has a large DTAA (82) and TIEA (6) treaty network

- Income Tax Overseas Units – Government of India decided to create a network of

- Income Tax Overseas Units (ITOUs). In addition to the existing two ITOUs at Singapore and Mauritius, 8 more have been opened.

- Setting up Cyber Forensic Labs and Work Stations- . Excellent results have been achieved in many search and seizure cases by availing of the expertise of forensic labs in Delhi and Mumbai

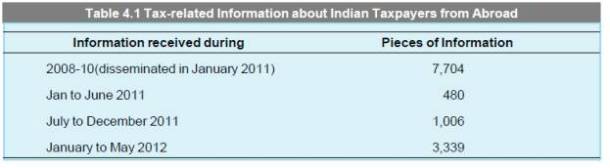

- In the last few years, more than 12,500 pieces of information regarding details of assets and payments received by Indian citizens in several countries including banking information have been obtained and are now under different stages of processing and investigation.

Source- White Paper on Black Money, 2012

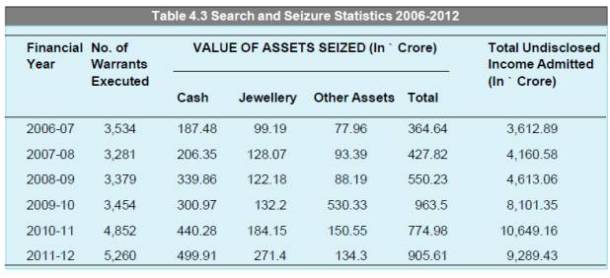

- In search and seizure action under section 132 of Income Tax Act, the Investigation Wing of the CBDT has detected concealed income of Rs 19,938 crore in the last two (2010 and 2011) financial years

Source- White Paper on Black Money, 2012

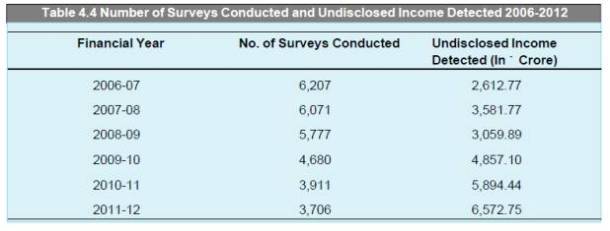

- The number of surveys conducted and under-reported income detected over the last few years.

Source- White Paper on Black Money, 2012

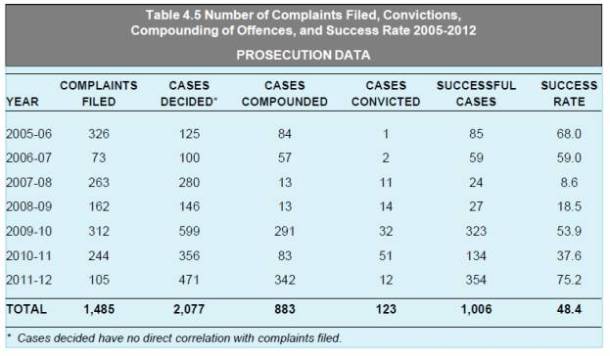

With a success rate of about 48 per cent convictions or fiscal compounding in the last six years, one of the highest amongst all law enforcement agencies in India

Source- White Paper on Black Money, 2012

- The Directorate of International Taxation has collected taxes of Rs 48,951 crore from cross-border transactions in the last few financial years

All the above facts show us a picture wherein, some progress has been taken in order to tackle Corruption and usher in some levels of Transparency . So in my humble opinion it would be wrong to paint the entire Government or the System with one single brush

Thank you for your patience